ASTS - Suckers at The Table

Of Memes and Men

“When you plant a fertile meme in my mind you literally parasitize my brain, turning it into a vehicle for the meme’s propagation in just the way that a virus may parasitize the genetic mechanism of a host cell.”

― Richard Dawkins, The Selfish Gene

ASTS is a high beta meme stock. That doesn’t mean the underlying business (AST SpaceMobile) is worthless, it means the stock is driven by narrative, leverage, algos, momentum traders, and a rabid cult of retail fan boys. Meme stocks swing wildly in the interim. ASTS is up 4,000% in the last two years after achieving several validating milestones, and despite a ~$40B enterprise value, it often swings 10% per day on no news. With any given meme stock, a chosen few will realize gains and retire rich, but true believers will ride their favorite meme to zero because it’s not about the money, it’s about the friends they made along the way. Cult stocks become their identity, they form meaningful online friendships with other rubes and construct impenetrable echo chambers. Anyone who says a negative word about their stock is a “retard.” Short sellers are not a counterbalance offering a variant perspective to stress test their thesis, we are their mortal enemies; criminals who must be humiliated and punished. I’ve witnessed similar behavior in past shorts like MVIS, SAVA, ENVX, and most notably AMC which was a mass delusion at such tremendous scale it should be a case study in psychology textbooks. Similar behavior from ASTS promoters is the reason it caught my eye. Cults are great shorts, but not easy shorts. The risk must be managed with care. For the general population, I offer a simple word of advice with this write up: Don’t. If you can’t find a better way to spend time, just make sure they’ve already passed around the Kool-Aid before you get involved.

Overview

AST SpaceMobile is attempting to build the world’s first space-based cellular broadband network with direct-to-device connectivity. ASTS BlueBirds are 2,400 square foot unfolding satellites (half a basketball court) and connect to 4G and 5G chips in current phones without terminals or specialized equipment. ASTS is building a constellation to provide global coverage and eliminate dead zones, or “connect the unconnected.” They operate a wholesale model, partnering with Mobile Network Operators (MNOs) rather than selling direct to consumer and the company has Memorandum of Understandings (MOUs) with over 50 MNOs globally. As of today, only a handful have progressed to definitive commercial agreements, and only Vodafone has explicitly agreed to a 50/50 revenue share.

MNO partners integrate ASTS coverage into existing service

Customers pay add-on fees for connectivity in remote areas

ASTS receives 50% revenue share

Government/Defense contracts, and B2B provide additional revenue potential

Bulls would have you believe ASTS will undoubtedly be one of the greatest, fastest scaling businesses in the history of capitalism. Back on planet Earth, the technology is promising, but unproven at scale and 98% of the constellation is incomplete. In addition, the timeline, consensus revenue estimates and margin assumptions are extremely aggressive. This business has limited pricing power, intense competition from well-capitalized rivals, and substantial execution risk in a capital-intensive industry. I believe ASTS will face headwinds meeting their timeline which will result in additional downside volatility in the stock price over the next 12-24 months.

The Bull Case

ASTS’ vertical integration makes it unique among predecessors. Unlike satellite firms that buy parts from 50 different contractors, ASTS builds almost every component of its BlueBirds in-house, mass-producing a single design. The giant satellites should last 7–10 years then ASTS just launches a newer, better version at roughly $21-$23M per satellite (as of today). SpaceX has driven down the price of space transport and ASTS is a primary beneficiary. Once the constellation is complete, the incremental cost of adding a user is virtually zero. CAC is also zero because MNOs handle customer acquisition, and they already have billions of customers. Because ASTS is a wholesaler, opex is limited giving them a SaaS-like margin profile despite building heavy physical infrastructure. Bullish models demonstrate the possibility if ASTS’ technology works as advertised and becomes the global roaming rail for the 3-5 billion mobile phones. If they win, they are essentially a utility with the margins of a software company.

Caveat To The Bull Case

ASTS still needs to build the constellation on-time, and people still need to be willing to pay for the add on service. If it takes ASTS 10 years to get 100 satellites up instead of 5, FCF shifts right, and the present value of the company collapses. If the satellites need to be replaced every 5-7 years instead of 7-10, or cost of production rises while service rates decline, capex goes higher, and margin assumptions implode. If demand for this niche service is weak and MNOs are unable to yield high attach rates or ARPU, the revenue assumptions crater. The bull case is not discounting execution risk and is dependent on what I believe are nearly impossible market penetration and ARPU assumptions and an overly optimistic timeline provided by managers who have been behind schedule on previous targets.

Unlike the touts, I’m willing to admit I may be wrong. ASTS’ technology is interesting and could be disruptive to terrestrial telecoms. Its story is compelling. Generally, it’s a much higher quality business than most other cult stocks I’ve encountered which are typically obvious frauds and promotes. ASTS is trying to build something big, and I applaud them for it. I don’t claim to be an expert on satellite technology, and I don’t care to become one. What I see is a stock trading at very presumptuous multiples in a sector that is historically difficult and capital intensive. I’m simply skeptical the stock will provide positive forward returns at its current price.

The best analogy for ASTS may be Rivian at its 2021 post-IPO peak. A new entrant in a hot sector where investors are blindly throwing money around hoping to catch the wave. ASTS bulls love to highlight SpaceX’s valuation as did LCID, RIVN, FSR bulls when TSLA went parabolic, and EV stocks became all the rage. FOMO is a helluva drug. This is best explained by the opening graphic in Capital Returns, “Wall Street’s Wheel of Fortune.” See if you can guess where ASTS investors are on the wheel.

Money is flowing into everything Space. Economic realities will take hold once ASTS is at scale with commercial service and MOUs become definitive. Anything can happen in the interim. If the launch timeline gets delayed and ASTS is not one of the most incredible, highest margin, fastest scaling businesses ever built I believe its stock is likely to drawdown 80-90% during the next bear market.

My goal is to assess what the equity may be worth in two scenarios:

The technology is real, the timeline is real, the TAM is large, the capex is minimal and the margins are incredible. (Which is currently the sell side consensus).

The technology is real, but the timeline gets delayed, the TAM is small, the capex is substantial, and the margins are average or below average.

Either it works and scales as advertised, or it doesn’t. More importantly to me, how reflective of either scenario is today’s stock price?

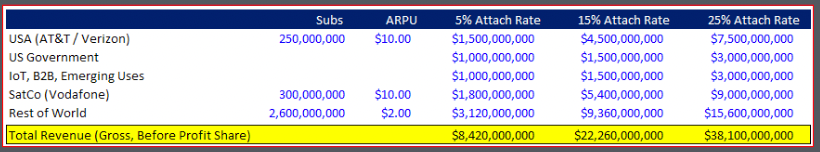

Bull Math

The Kook Report is one of the most popular ASTS online influencers, and he’s put together a nice deck laying out a thorough and well researched bull case. I genuinely like Kook, he’s one of the few ASTS accounts who has never behaved like an unhinged psychopath in my replies.

Kook’s valuation approach (along with many other bulls) uses an EBITDA multiple. But ASTS must consistently launch new satellites FOREVER just to keep the service running, this is effectively a cost of doing business. They currently cost $21-$23M each (29% higher than management’s previous guidance). That money is gone from ASTS’ bank account post-build, so why are bulls valuing the business as if it’s not real? Adding back depreciation pretends this is not a real expense when it’s the primary expense, overstating profitability.

Kook’s revenue floor of $4.4B is built on the premise of billable data of 15–30 million GB per satellite per year at a wholesale prices. But ASTS doesn’t sell data by the gigabyte to carriers they share revenue from whatever the carrier charges end-users (which is still undefined). This makes the assumptions muddy. The blended ARPU which can vary widely by region adds far too much noise to the model. With no disrespect to Kook, these inputs are extremely sensitive to small tweaks and so far off in the future discounting them to present value with an EBITDA multiple is pointless. If anything, you should adjust for the ramp, and simply model 7-10 year replacement cycles, but even then I think EBITDA is the wrong multiple.

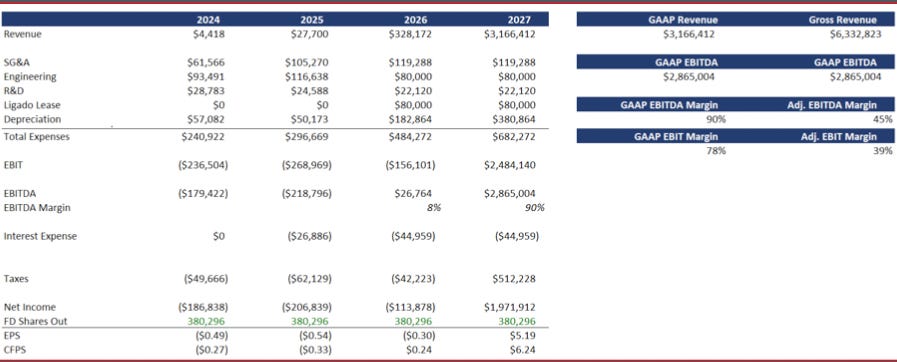

It’s Jan 2026 today, this model assumes by FY27 ASTS will generate $3.2B in revenue and $2B in Net Income. A 65% Net Income margin. Better than Visa, Mastercard, or NVIDIA within 24 months. I doubt it. To Kook’s credit, he’s more concerned about the constellation’s full potential at scale rather than an exact timeline. So, let’s assume his mid-range projections come true. ASTS generates $11B in annual revenue with a 50% FCF margin, ~$5.5B or a 16% FCF yield at today’s price. Sounds pretty good. But wait, this hypothetical is ASTS at maturity, so what’s being discounted between now and then? AST has to build, launch, maintain, and replace hundreds of giant satellites, secure definitive agreements from MNOs, renegotiate the definitive agreements they have (upon expiry), clear major FCC regulatory hurdles, secure government contracts, beat SpaceX and any new entrants while maintaining pricing power in a commodity business. Then MNOs must convince a large swath of developed market users to increase their bill by 10-30% for a niche service, and convince emerging market mobile users to increase their bills by 50-100%. ASTS will somehow do all this with a steady state FCF margin rivaled only by the best businesses in history, and oh yeah, it’s at minimum 5 years of market risk on top of all the execution risk. Sounds like a lay-up!

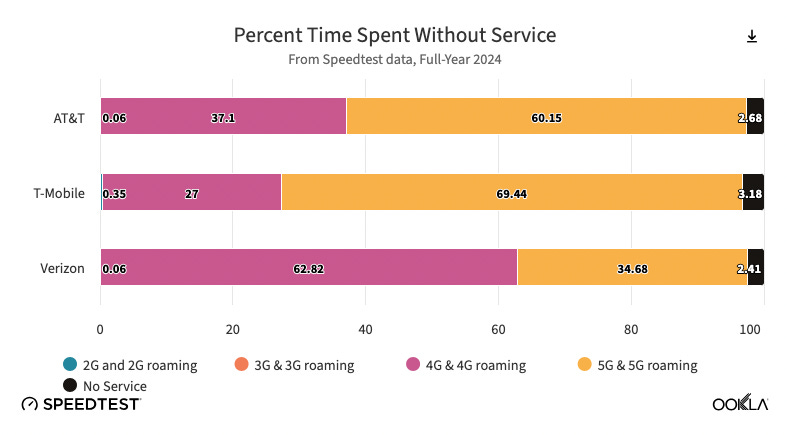

I have a very hard time believing the TAM story. Even in rural areas most Americans have excellent service. US mobile users have cell service 97% of the time. I find it difficult to believe even 15% of average customers will pay $10 per month for the additional 3% coverage. More likely ASTS servince will be used as a marketing gimmick to promote “100% worldwide coverage” for premium packages.

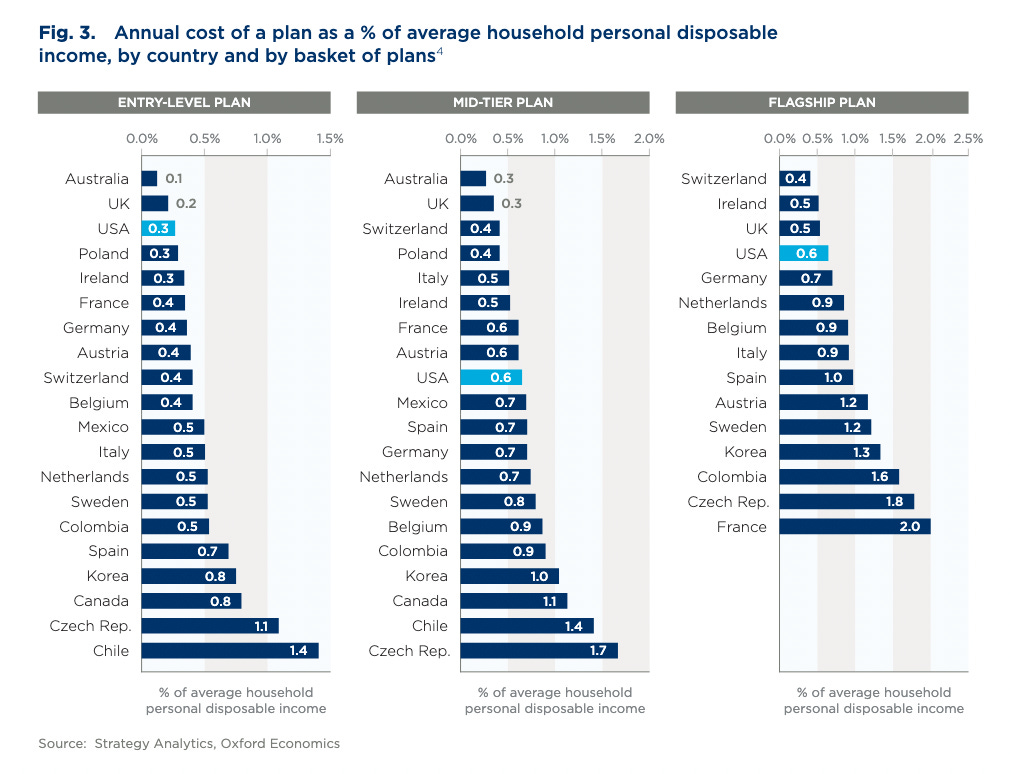

And while the US may have higher nominal costs, we have the cheapest plans in terms of percent of disposable income, so increasing costs in RoW is much more impactful and likely to face resistance and churn.

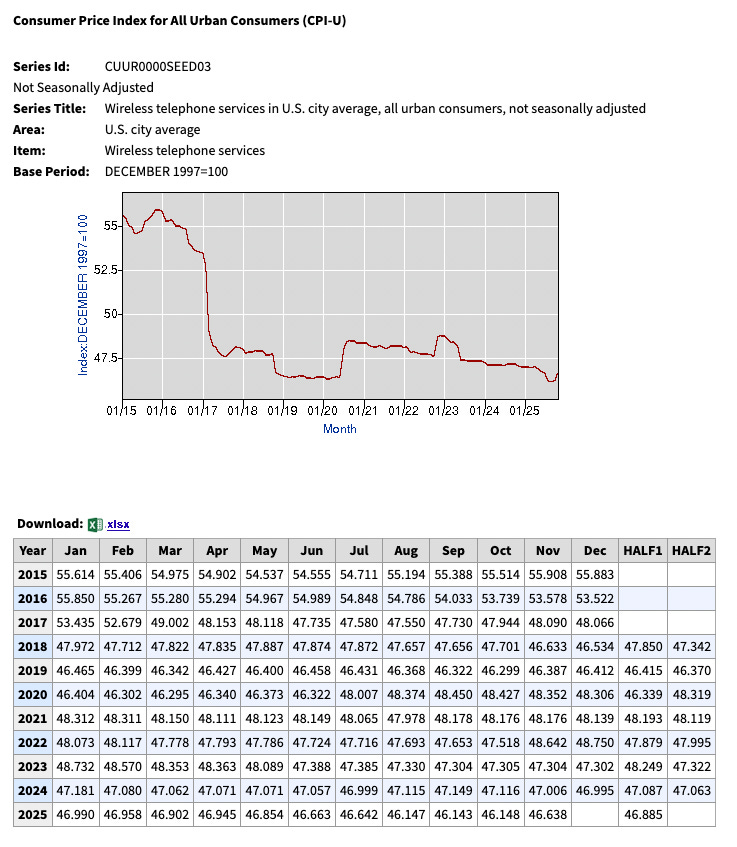

The $10-$15/month developed market ARPU in the bull case is unrealistic in the long-term. T-Mobile/Starlink is already pricing direct-to-cell at $10-15/month or including it free in premium plans. $10-$15 is not a floor, it’s a ceiling. MNOs face significant churn risk if they price aggressively for a feature that delivers intermittent value compared to ubiquitous terrestrial coverage. Wireless service costs have declined substantially as subscriptions become more common. There’s no reason to believe the same won’t be true for satellite coverage.

Golden Dome Hopium

In February 2025, ASTS announced $43M contract award from the Space Development Agency. I fully agree dual use is probable, but government revenue should be discounted heavily in a rational model because it’s not tangible yet. These are not signed multi-billion-dollar revenue streams, they are vague intentions from a dysfunctional administration that will most likely lose the house in 2026 midterms. ASTS isn’t contracting directly with the SDA they’re a subcontractor working under a larger undisclosed “prime contractor.” Subcontractors have less control and lower margins because 10-30% of the contract award goes to the prime contractor. As I mention in my Booz Allen Hamilton write up it’s an onerous task to make the US government your customer, especially in the defense sector.

“Booz has tens of thousands of employees holding active security clearances which in and of itself is a multi-year, multi-billion-dollar logistical barrier for competitors. Booz holds prime spots on dozens of government-wide contracts like GSA schedules. These are pre-competed “hunting licenses” that allow agencies to hire BAH with minimal paperwork. A company not on these vehicles can’t even bid for the work. The U.S. government is the most difficult customer in the world. A contractor must master the Defense Contract Audit Agency accounting rules, Cybersecurity Maturity Model Certification, and a hellscape of other regulations. I suspect this is why many big tech firms like Meta, Google, Amazon, and Microsoft have partnered with Booz Allen instead of competing with them.”

The $43M from Space Force and $20M from the Defense Innovation Unit represent significant validation ASTS’ technology, but how much revenue will these eventually yield assuming they evolve into larger contracts?

Here are some recent SDA awards:

Tranche 3

$3.5 billion total for 72 satellites across 4 companies.

Lockheed Martin: $1.1 billion for 18 satellites;

L3Harris: $843 million for 18 satellites;

Rocket Lab: $805 million for 18 satellites;

Northrop Grumman: $764 million for 18 satellites.

~$45-60M per satellite

SDA revenue is not a lump sum, it’s spread across a 4-6 year performance period. Each tranche awards $500M-$3.5B every two years. So if bulls are modeling $1B in government revenue annually that assumes ASTS will win nearly 60% of these contracts against well capitalized rivals with deeper pockets, proven success, and entrenched networks of lobbyists. This is highly improbable.

Aggressively bullish case: ASTS becomes primary provider = $800M-1.5B per tranche $400-750M annually. Which means there’s a large gap that must be filled by additional contracts. As of today this is all hand-waving and contingent upon congressional approval. No conservative valuation model should just slap an extra $1B in revenue on and call it a day. Same goes for B2B IoT revenue. Use cases like agriculture, maritime tracking, logistics, remote infrastructure etc do exist, but this is all mystery meat.

Execution Risk

Timeline delays are the biggest risk to the stock price.

Why should I put faith in the same management that presented these wildly off the mark SPAC projections? I prefer managers who under-promise and over-deliver. ASTS missed the mark on their projections due to a combination of technical complexities, supplier failures, launch delays, and evolving regulatory hurdles. There will inevitably be additional headwinds and they still need to build 98% of the constellation. As more birds get launched risk of deployment failures or mechanical issues with large unfolding structures grows. As does debris strike risk on large surface area satellites. A lot can go wrong here, and at today’s market price I’m comfortable assuming something will.

Expenses

If the constellation costs $5.5B (248 satellites at $22M) and lasts 7 years, ASTS must spend $779M annually on capex. This is nearly a 100% increase to many sell side estimates if the lifespan of the satellites just comes in at the low end of management’s guide. ASTS’ SPAC deck projections did not account for the rising costs of space infrastructure. The estimated average capital cost per Block 2 satellite rose from $16-$18M to $21-$23M as of today. New satellite designs to keep up with technological advancements will demand heavy upfront manufacturing investments. Even the most efficient telecom infrastructure companies like American Tower rarely see FCF margins exceed 30–40%, and their towers last 20–30 years, but I’m supposed to believe ASTS’ will achieve 65% at scale? I doubt it.

Additional costs: Insurance, debris and maneuvering, ground segment, regulatory compliance all may be underrepresented. As LEO becomes more crowded, satellites must use fuel for collision avoidance, shortening their lifespan and increasing opex. Maintaining the global network of gateway stations and terrestrial links is another expense that scales as the network grows. As the skies become more cluttered, future “space taxes” or stricter de-orbiting regulations could add unforeseen costs to every satellite launched and blow-up current models.

Wholesale Model Creates Weak Pricing Power

The “>50% FCF margin” narrative assumes ASTS can maintain high pricing power indefinitely. But this is a commodity business, and those rarely have pricing power. ASTS subscribers will never know who provided the service because it’s offered by their preferred MNO. As more players beyond Starlink, Lynk, and Kuiper, enter the D2C market, the price per GB will inevitably fall and squeeze everyone’s margins.

ASTS’ wholesale model creates structural dependence on carriers to promote the service. The company has zero control over customer acquisition, pricing strategy, or service packaging. MNOs retain full discretion over whether to actively market AST connectivity, how prominently to feature it in their offerings, and what price to charge end users.

This dependence is problematic given only Vodafone has publicly confirmed a 50% revenue share arrangement. Other partnerships remain under MOUs or preliminary agreements that could result in less favorable economics as they convert to definitive commercial terms. MNOs hold significant leverage in negotiations since AST lacks alternative distribution channels. The definitive agreements ASTS has secured have short durations and may expire before the constellation is fully deployed. The remaining 45+ partnerships are preliminary understandings that create no binding obligation for the MNOs to move forward.

ASTS must successfully demonstrate service quality and viability within narrow time frames to convert preliminary interest into long-term revenue commitments. Any delays in constellation deployment or service quality issues could result in partnership terminations or renegotiations on less favorable terms. If relationships deteriorate or MNOs decide to partner with competitors like Starlink, ASTS has no alternative path to market.

Starlink Direct-to-Cell

Dismissing Starlink as “inferior technology” is ridiculous. Starlink has scale and a massive advantage of vertically integrated launches. They are the elephant in the room with nearly unlimited access to capital. This is a technological Red Queen race and Starlink is not sitting idly by. Thinking you can predict the future of this nascent industry with high accuracy is outright arrogance. Starlink has already deployed over 650 Direct-to-Cell satellites with nationwide with messaging capability and expanding data/voice services through its partnership with T-Mobile.

SpaceX has aggressively petitioned the FCC to waive standard Equivalent Power Flux Density limits. Starlink argues if they can transmit at higher power, (“shout” louder), they don’t need a 2,400 square foot antenna like ASTS. This is the core of their current legal battle with AT&T and Verizon, who claim Starlink’s “louder” satellites will cause interference with terrestrial networks. There are few people I find more repulsive than Musk, but I would not underestimate his ability to influence or skirt regulators.

Starlink competitive advantages:

Massive satellite volume enabling lower latency and consistent coverage

Proven mass manufacturing capability and launch infrastructure

Significantly more capital resources

First-mover advantage in deployment timeline

Global partnership strategy with 27+ MNOs across multiple markets

Entrenched government networks

Most critically, SpaceX is ASTS’ primary launch provider as of today. ASTS is paying its primary competitor for launch services. If SpaceX prioritizes its own constellation due to bad weather patterns and technical issues, or increases launch pricing, ASTS’ deployment timeline and economics could deteriorate rapidly. Elon can kneecap ASTS anytime he pleases, but would risk antitrust scrutiny to do so.

Starlink has more launch capacity, more satellites in orbit, and more capital than ASTS can dream of. The one point I will concede is Starlink intends to compete directly with MNOs which may motivate them to prefer ASTS granted the quality of service is up to par.

Conservative (Still Optimistic) Scenario

550M DM Subs - $10 Gross Monthly ARPU, 10% penetration ~$3.3B

2.5B EM subs - $0.5 Gross Monthly ARPU, 15% penetration ~$2.3B

$700M in Government revenue

$250M from B2B IoT

This is giving ASTS the credit of successfully achieving scale despite having only 2% of the constellation launched. Total Annual Revenue = $6.6B, at a 30% FCF margin = $1.97B in Annual FCF. Or a 5% FCF yield at today’s price of $100 per share. We’re talking about a yield you can almost get in a T-Bond to own something with tremendous execution risk and a very long-time horizon. Why? Anything beyond perfect execution will result in a negative forward return.

Bulls will argue this is overly bearish. I don’t care. The same bulls will claim ASTS is worth $1 trillion based on imaginary EBITDA and relative valuation to SpaceX’s possible IPO price. I’ll believe it when I see it.

My conservative scenario reflects more realistic assumptions where the company achieves partial technical success but faces structural headwinds from competition, weak bargaining position with partners, limited consumer demand, and challenging unit economics.

Summary

Over the long-term, ASTS represents an asymmetric risk to the downside. The bull case requires near-perfect execution across multiple dimensions simultaneously: successful mass manufacturing, on-schedule deployment, technology performance at scale, favorable commercial terms with MNOs, strong consumer adoption, and sustainable pricing. The probability of achieving all these outcomes appears low given the numerous failure points.

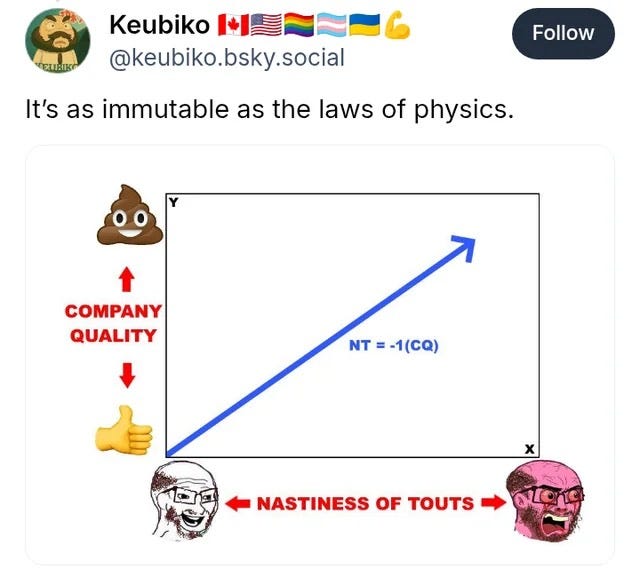

Keubiko’s Law

Cults are great shorts because the marginal buyer of the stock is completely irrational. Many #SpaceMob cult members have “know what you own” in their social media bio. Other than Kook, I can’t imagine a group with less ability to analyze satellite and space travel technology. They’ve convinced themselves that reading 100-page deep dives from other bulls is “knowing.” Most of them have absolutely no idea what they own, or more importantly what it’s worth. Neither do I, but under a range of outcomes I believe there’s a very high probability it’s worth much less than $40B.

They all claim to be long-term holders, yet they’re hyper focused on every tick of the stock price. ASTS beta is 2.7, the 10% daily swings only amplify their dopamine rush. When it’s down, they scream about manipulation. When it’s up, they take victory laps on the shorts and share pictures of imaginary Lambo parties.

Meme stocks, sports betting, crypto, precious metals, 0DTEs, AI story stocks, it’s all the same picture. Lonely young men with no direction gambling on the internet, hoping whichever meme they’re involved in will be a winning lottery ticket. Ken Griffin thanks you for his next dinosaur fossil. Some have already made life changing gains, many will give those gains back as they average down while anchoring to all-time-highs, never comprehending the bust has arrived. Most touts are highly concentrated, entering well after the first parabolic move at prices guaranteed to see a negative return. This is why they’re so angry and vicious despite the stock appreciating 4,000% over the last two years. They are new entrants to the cult and the vast majority have not gotten rich holding ASTS, they’ve been pulled in by other promoters bragging about their gains online and confidently shouting about price targets 1000% higher. Meme stocks are akin to pyramid schemes, the recruitment of new buyers is the priority and crucial to maintain the pump.

My best shorts have all had rabid online fan bases who hurl insults at anyone who is even slightly negative about their stock promote. They pop up in my mentions every time I tweet about ASTS, and it makes me smile. Every nasty comment is just confirmation the people on the other side of the trade are suckers at the table. Given its meme status, ASTS could easily be up triple digits in 2026. And I’m sure the touts will be beating their chest and dunking on me nonstop if it is. That’s fine. I’ve sized it appropriately and I won’t press it until I’m confident the pump is over. When all is said and done, if the financial performance of ASTS demonstrates I’m wrong, I will cover my short, eat losses and move on with life. But most likely, I will drink their tears and bury them next to my previous cult shorts. I’m in no rush to do so.

The winners will be ASTS managers and SPAC sponsors, market makers, fast money traders/pods who rode the momentum without marrying the stock, and the surviving shorts who did not get involved too early or too aggressively. The idea that stock prices can often disconnect from business fundamentals and provide an opportunity to profit is the basis of all active investing, but in late-stage bull markets it’s common for shorts to be villainized. I’m fine with being your imaginary villain.

“But the risk of shorting is asymmetric, you can have infinite losses but only gain 100% if the stock goes to zero!!”

This is my favorite misconception about short selling. When a stock that’s worth zero gets cut in half, the downside is still 100%. Short positions naturally shrink if they work, but nothing is stopping the short seller from adding on bounces. My return shorting AMC was north of 300% and AMC was an easier short after it had been cut in half. Still volatile, but marginal buyers and half-hearted cult members begin leaking out, and negative momentum loses the algos and pods. Once the parabolic move is several months in the rearview it’s unlikely to ever regain the highs.

I do not have the expertise to tell you if the constellation build will be successful, or if ASTS’ signal will be fast and clear through buildings at scale, or how much fuel it will cost to maneuver these giant satellites out of harm’s way, or even how many people will pay for the service. The bulls may be right that this technology is amazing, and its patents are an iron clad moat only a few years away from building a cash flow machine never before seen in the history of capitalism. Not plausible, but possible. What I can do is consider the equity under a range of economic scenarios, and there’s almost no scenario I see in which ASTS’ intrinsic value is anywhere close to today’s price. Time will tell.

Risks

AT&T may offer beta service with Firstnet in the first half of this year

Successful satellite launches creating positive headlines / momentum (45-60 planned in 2026)

SpaceX IPO at $1.5T creating increased sector FOMO

New partnership announcements especially from big tech or conversion of MOUs to definitive agreements

Government contract announcements providing revenue visibility

Retail investor enthusiasm driving sustained momentum regardless of fundamentals

Disclosure

I am short ASTS.

This newsletter provides general ideas, not personalized investment counsel. All materials associated with this subscription and website, including articles, reports, and other features, are published for informational, educational and entertainment purposes exclusively. This content does not constitute investment advice, nor should it be interpreted as such. Any actions you take or decisions you make based on this content are entirely your own responsibility. Neither the author nor any affiliated parties will accept liability for any loss or damage, direct or consequential, arising from the use of the information provided.

This service does not issue trading signals, specific buy/sell recommendations, or any directive to trade. Nothing presented herein constitutes a solicitation or an offer to buy or sell any security. All sources are publicly available, but this information may contain errors. There is no guarantee, explicit or implied, that any ideas or securities discussed will replicate past performance.

The author may hold positions in the securities mentioned in these publications; these will be disclosed at the time of writing. There is no guarantee that the author will continue to hold these positions.

This is the greatest thing I've ever read

as far as i understand it only ASTS has the capability for direct to phone :

Starlink Direct to Cell: Starlink describes “Text” as available since 2024 and “Data & IoT” since 2025, with “Voice” listed as available with apps (and real-world capability varying by partner/operator rollout and approvals).[starlink]

• AST SpaceMobile: AST and carrier partners (e.g., Vodafone; Rakuten in Japan) have announced two-way satellite-to-mobile video call demonstrations using everyday, unmodified smartphones.