First Advantage

Tactical Trade

First Advantage is a tactical trade on a labor market inflection with valuation support. The stock is -33% over the past month and -47% from its 52-week high on soft hiring volumes, tariff-driven policy uncertainty, and nonsensical AI fears. FA currently trades at 8x FY26 EV/EBITDA and a 6% unlevered FCF yield. Stabilization in hiring volumes is sufficient to re-rate the stock, and a strong fiscal backdrop makes recession risk highly unlikely with a potential for reacceleration that could drive FA back to $20 per share or 90% upside from its current price in a bull case scenario. $15 is my base case with an implied 43% upside from today’s price of $10.50.

FA’s revenue model is a simple toll on hiring. Every background check, drug screen, identity verification, and I-9 triggered by a hiring event at large enterprises generates a per-unit fee. This makes JOLTS hires the best proxy for FA’s top-line growth. The stock trades like a leveraged bet on hiring, and right now, hiring sentiment is at a trough.

Labor Market Is Bottoming

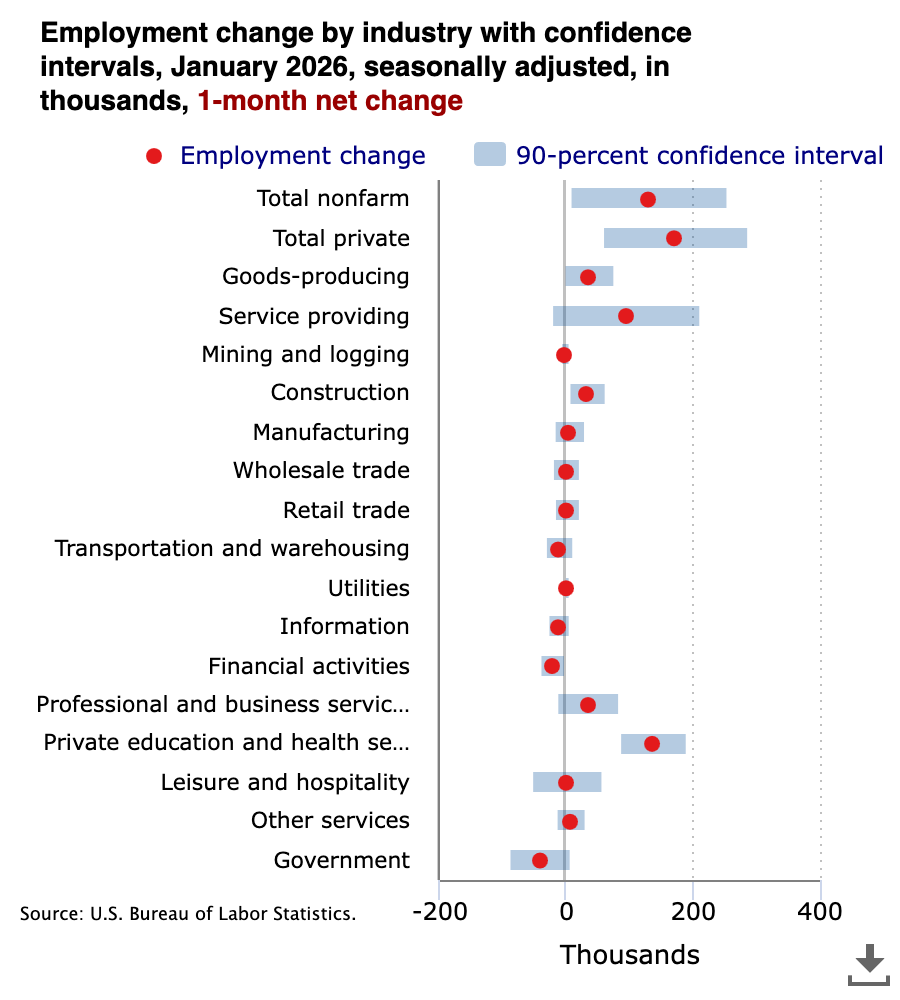

Today’s nonfarm payrolls report showed job growth of 130,000 last month, well above the 55,000 estimates (although it may get revised lower). This is a notable increase from December, which was revised down to 48,000. The unemployment rate came in at 4.3%, below the 4.4% estimate. This does not appear to be a rapidly deteriorating labor market, just flat and mostly benign, as First Advantage management has been expecting.

“Looking at the macro environment, we are still seeing a trend where hiring is remaining consistently flat. Macro uncertainty as well as policy changes, including the recent government shutdown, immigration, tariffs and tax policy have resulted in many of our customers remaining in a wait-and-see posture as it relates to their hiring plans.

However, as you can see from our results, our customers are still hiring at consistent levels. Our expectation for the fourth quarter and likely into 2026 is for base growth to remain slightly negative as the overall labor market conditions persist. We continue to be confident in our ability to deliver overall revenue growth through upsell, cross-sell”

Scott Staples, CEO – Nov. 2025

The labor market is undeniably soft, but macro is filled with noise especially given the noisiest administration of all-time creating a new policy shock every other week. Nonetheless, initial jobless claims remain contained. The recent spike was largely attributed to severe winter storms, not structural deterioration and there’s no evidence of widespread layoffs despite clickbait headlines about AI destroying white collar work. The OBBBA is pumping a massive amount of fiscal into the economy ahead of midterms which should be supportive for hiring.

The ISM Manufacturing PMI rebounded to 52.6, the first reading above 50 in twelve months and the highest since August 2022. Manufacturing PMI employment sub-indices bottoming is a typically a leading indicator for broader labor market turns.

Catalysts for Second Half Recovery

Federal Reserve rate cuts lower borrowing costs and unlock hiring budgets.

Tax provisions from the OBBBA including reinstatement of 100% bonus depreciation and individual tax refunds. This will boost disposable income and investment in H1 2026 with lagging effects into H2.

Deregulation tailwinds further fueling investment and easing access to capital.

Pent-up replacement demand as companies that deferred hiring through tariff uncertainty are forced to fill critical roles.

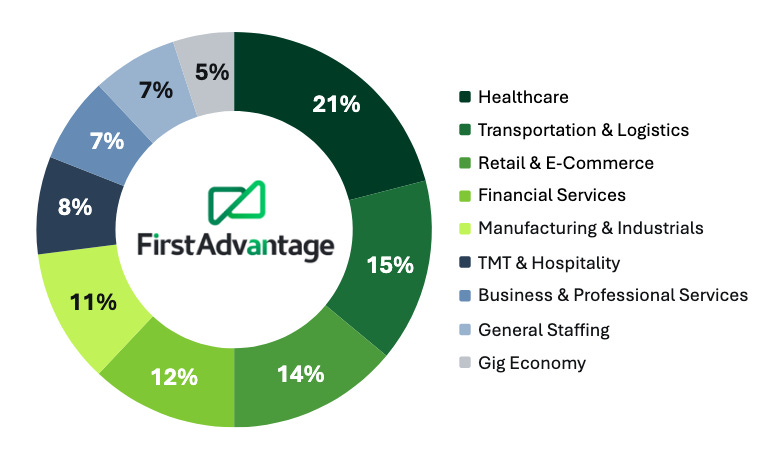

Secular growth in healthcare hiring is robust, which now represents 21% of FA’s revenue following the Sterling acquisition.

FA does not require a boom to work, it requires the market to stop pricing in continued deterioration.

Database Moat

There is no comprehensive national criminal database in the United States available to private employers. Criminal records are maintained at the county level across 3,100+ counties, each with its own system, formats, access rules, and update schedules. The fragmentation is extreme and electronic access is limited. First Advantage maintains networks of runners who physically walk into courthouses to access records. First Advantage is more of a logistics network than a software company and its human infrastructure took decades to build and cannot be easily replicated.

National Criminal Record File

FA’s proprietary NCRF contains more than 780 million records (and growing). The NCRF narrows down which jurisdictions need to be physically checked, and flags records from jurisdictions a candidate failed to disclose. This is a data flywheel. More customers, more screens, more records, better coverage, which attracts more customers. A new entrant running 1 million screens per year simply cannot accumulate what FA has built by running 100 million.

“On the National Criminal Record File, none of that is third-party data. It’s all public available data… When you go to a third party, you’re not legally able to reuse that data. So think of it this way. We do a background check on you and we hit a database in a county or a state or even a federal database. That’s the data we’re keeping in the National Criminal Record file, and we can reuse that data the next time you go for a background check because you’re getting consent to use that data.”

Scott Staples, CEO – Nov. 2025

HCM Integration Moat

FA is integrated into 100+ Human Capital Management platforms. An AI startup or new entrant cannot disrupt FA because the screening workflow is embedded with high switching costs, hence FA’s 96-97% customer retention rates. After the Sterling Check acquisition, HireRight is First Advantage’s only direct competitor in enterprise resulting in a duopoly with substantial pricing power.

Exceeding Targets

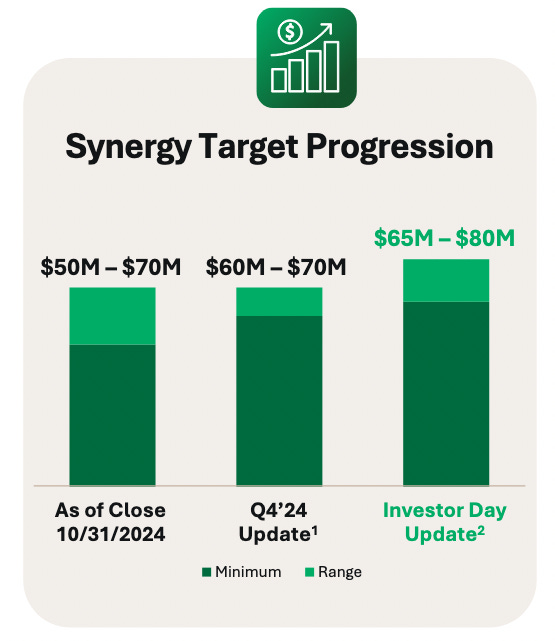

Management’s original synergy target of $50–70 million in run-rate cost savings within 18–24 months of close was raised to $65–80 million at last May’s investor day. Through Q3 2025, $52 million in synergies had already been actioned. This is ahead of schedule by any measure and demonstrates a management team capable of under-promising and over-delivering.

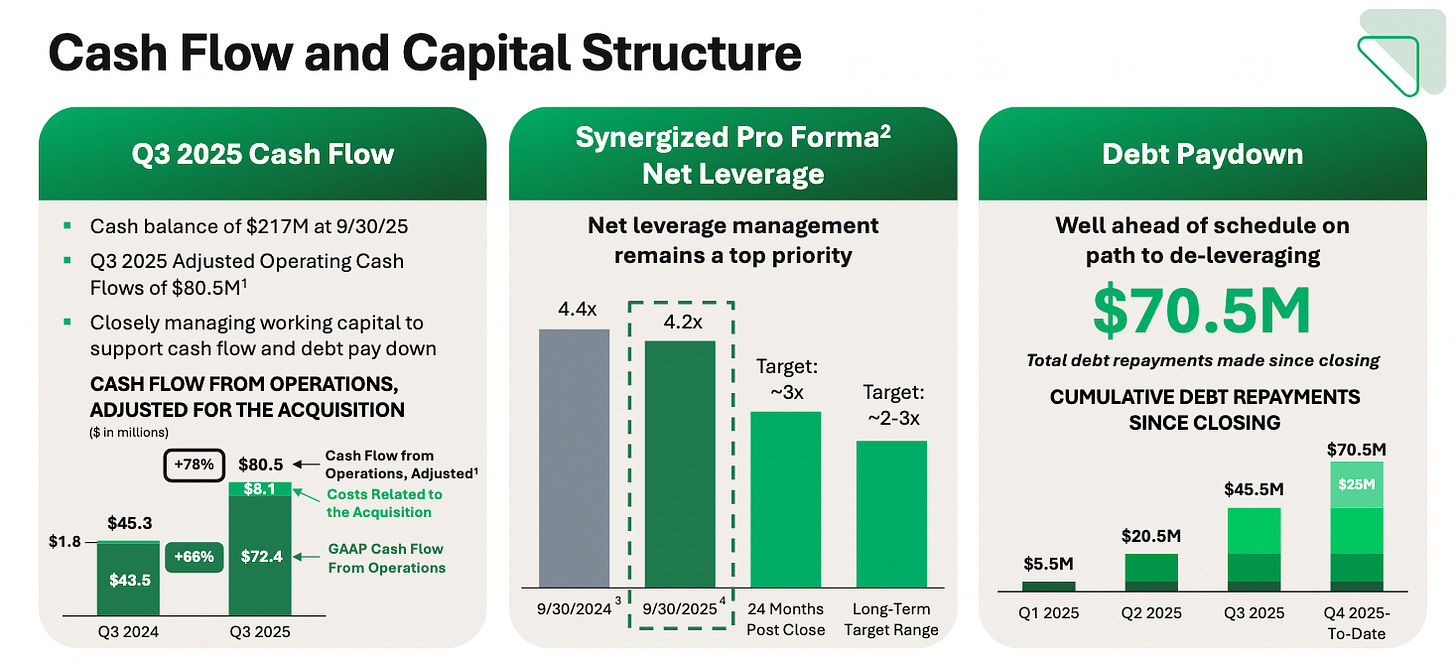

Post-acquisition net leverage stood at 4.3x. Management targeted 3.0x by year-end 2026, with a longer-term target of 2–3x. Through Q3 2025, FA made over $70 million in debt repayments and reduced borrowing rates by 50bps generating approximately $10 million in annual cash interest savings. Deleveraging is also currently ahead of schedule.

Valuation

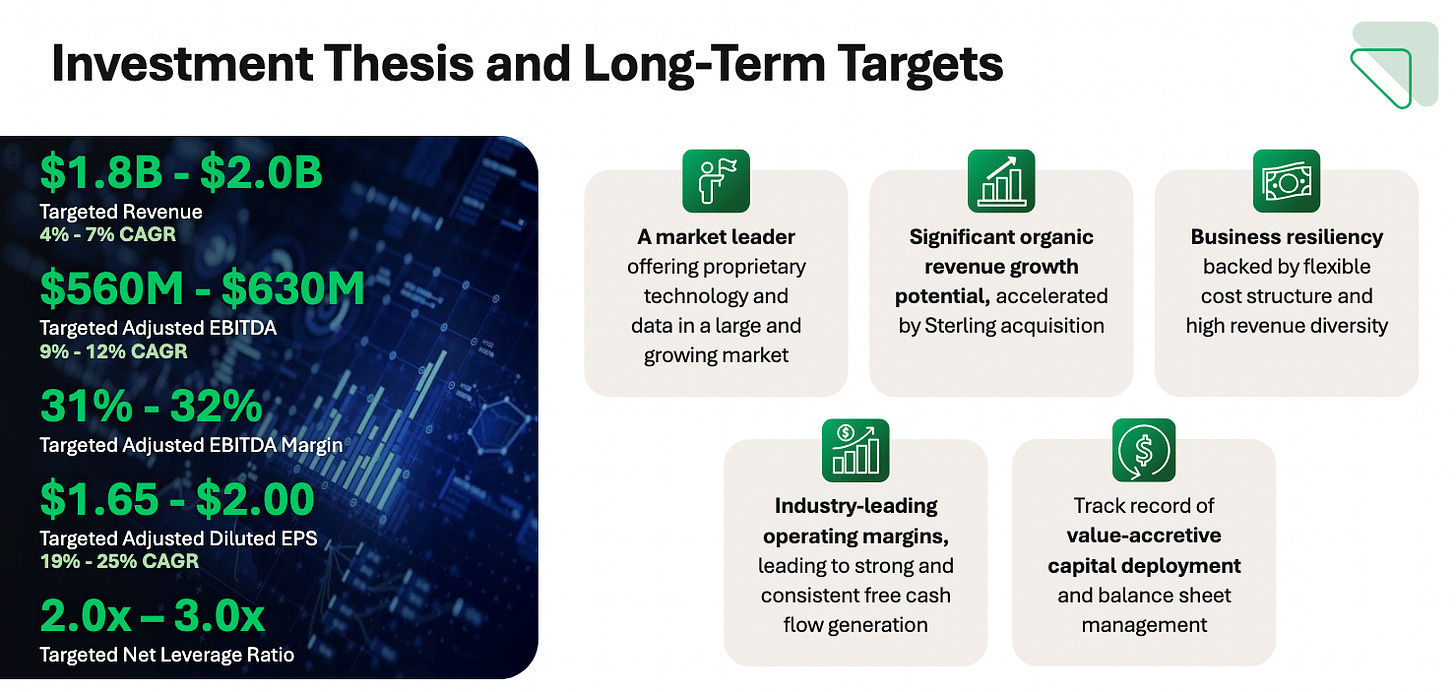

If Management reaches the midpoint of their FY28 financial targets, at $10.50 per share, FA trades at <2x EV/Sales, 10x EV/EBIT, 5x EV/EBITDA, and 6x EPS for a capital light duopoly with pricing power and 96-97% customer retention rate.

The market is assuming continued deceleration in hiring and limited margin expansion. A re-rating to 10–12x forward EV/EBITDA, (which is in line with the historical range) implies 30–60% upside from today’s price. Most likely FA is a baby getting thrown out with the SaaS bathwater, and I’m a buyer at today’s price.

Risks

Silver Lake owns ~51.5% of FA’s equity. The exit is a question of when, not if, but they haven’t sold shares in the past 18 months, and the current depressed stock price makes a near-term exit less likely without a greater macro shock that causes a forced sale. Though I should note Silver Lake is highly exposed to software, which is currently in a bear market.

The bull case for labor recovery in the second half of 2026 depends on fiscal stimulus from the OBBBA providing a floor for the economy. But this stimulus may prove to be a sugar high, and partially offset by rising costs as a result of cuts to healthcare, SNAP benefits, and higher costs due to tariffs. If unemployment climbs to 5% or above, FA’s volume decline would surely result in a guidance cut and additional downside in the stock.

FA’s management has guided for this “slightly negative” trend to persist into 2026. If hiring volumes fail to stabilize, or if AI-driven efficiency gains accelerate the trend of companies doing more with fewer workers, FA’s volume headwind could persist longer than expected, pushing FY28 targets out further. Macro could result in a sideways or downward grind and managers have no levers beyond cross-selling and upselling to fuel organic growth.

Long-Term Risk

FA’s core moat is its data access. The physical courthouse data and deep HCM integrations are durable for the medium term at least. AI is a net positive for FA’s margins in the near term (internal efficiency gains), but probably a gradual headwind to pricing power over time as records become digitized. Thankfully for FA investors, local bureaucracy moves at a glacial pace.

But in reality, the courthouse access moat is a melting ice cube even if it’s a slow melt. With each new electronic portal FA loses its advantage. This is a 10-20 year risk, but investors may be heavily discounting the terminal value making re-rating an uphill battle. Hopefully I won’t be in the stock long enough to find out.

I Hate Macro

Generally, I try to remain macro agnostic which is easier said than done these days. Forecasting the labor market six months in advance takes a bit of hubris. As the saying goes, “God invented economists to make Astrologers look good.” This is a trade, not a long-term investment. I’m trying to time a cyclical bottom in the labor market and it’s probably a stupid game which may result in a stupid prize. I see rate cuts, OBBBA stimulus, pent-up replacement demand, and deregulation as clear catalysts, but it may blow up in my face. FA’s valuation and quality management provides a margin of safety I’m comfortable with, though I did just swear off deleveraging stories after JACK, yet here I am again. Ahead-of-schedule execution on synergies and deleveraging provides additional potential for re-rating, but hiring volumes matters most, and the former is less likely to happen without the latter.

Disclosure

I am long FA.

This newsletter provides general ideas, not personalized investment counsel. All materials associated with this subscription and website, including articles, reports, and other features, are published for informational, educational and entertainment purposes exclusively. This content does not constitute investment advice, nor should it be interpreted as such. Any actions you take or decisions you make based on this content are entirely your own responsibility. Neither the author nor any affiliated parties will accept liability for any loss or damage, direct or consequential, arising from the use of the information provided.

This service does not issue trading signals, specific buy/sell recommendations, or any directive to trade. Nothing presented herein constitutes a solicitation or an offer to buy or sell any security. All sources are publicly available, but this information may contain errors. There is no guarantee, explicit or implied, that any ideas or securities discussed will replicate past performance.

The author may hold positions in the securities mentioned in these publications; these will be disclosed at the time of writing. There is no guarantee that the author will continue to hold these positions.

Interesting piece. A few questions.

1) AI got really good at some things like facial recognition and identifying people (see something like Lenso), where’s the moat here?

2) I get that first advantage has a moat in collected data, but can’t AI just get this from the source? Companies like Checkr and Truv use APIs to let candidates log into their own payroll accounts (e.g., ADP, Workday, Paychex, or Gusto), or the AI agent can just login to the government’s public court record websites for the data.

I don’t really see you address the existential AI risk there despite the very attractive numbers. Maybe that implementation takes too long to matter for FA’s valuation. Time will tell.